LEGALLY REQUIRED ADVERTISEMENTS AND PUBLIC NOTICES

On June 10, 2024, the School Board of Lake County, Florida, approved using its publicly accessible website to publish legally required advertisements and public notices per Florida Statute 50.0311, effective July 1, 2024.

In accordance with Section 50.0311(6), Florida Statutes, property owners and residents can opt to receive these notices directly by first-class mail or email. To register, please provide your name, address, and email address (and preferred method of delivery) to the Clerk of the School Board of Lake County, Florida, at:

Current Public Notices

Public notices are stored online for 18 months before removal from this webpage.

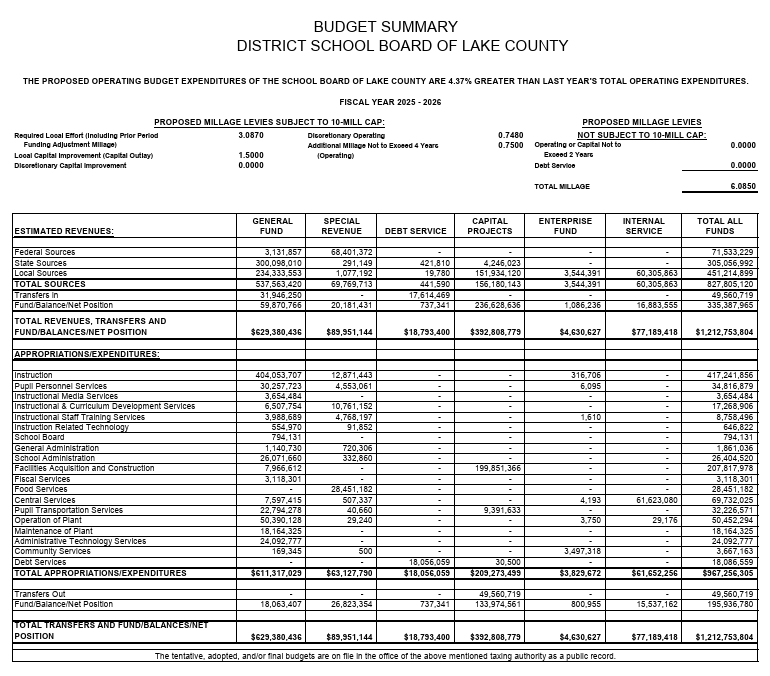

Budget Summary (Posted July 24, 2025)

NOTICE OF PROPOSED TAX INCREASE (Posted July 24, 2025)

The Lake County School Board will soon consider a measure to increase its property tax levy.

Last year's property tax levy:

A. Initially proposed tax levy……..……...............…………………………$ 275,894,269

B. Less tax reductions due to Value Adjustment Board

and other assessment changes……………...................………...…………… $ 717,849

C. Actual property tax levy………...……...…..............…………………… $ 275,176,420

This year's proposed tax levy……………..............……………………$300,221,807

A portion of the tax levy is required under state law for the school board to receive $230,635,849 in state education grants.

The required portion has increased by 3.96 percent, and represents approximately five tenths of the total proposed taxes.

The remainder of the taxes is proposed solely at the discretion of the school board.

All concerned citizens are invited to a public hearing to be held on July 28, 2025, at 5:05 PM in the Commission Chambers, Lake County Administrative Building, 315 W. Main Street, Tavares, FL.

A DECISION on the proposed tax increase and the budget will be made at this hearing.

NOTICE OF TAX FOR SCHOOL CAPITAL OUTLAY (Posted July 24, 2025)

The Lake County School Board will soon consider a measure to continue to impose a 1.50 mill property tax for the capital outlay projects listed herein.

This tax is in addition to the school board's proposed tax of 4.585 mills for operating expenses and is proposed solely at the discretion of the school board.

**THE PROPOSED COMBINED SCHOOL BOARD TAX INCREASE FOR BOTH OPERATING EXPENSES AND CAPITAL OUTLAY IS SHOWN IN THE ADJACENT NOTICE.

The capital outlay tax will generate approximately $71,046,739 to be used for the following projects:

CONSTRUCTION AND REMODELING

New construction, remodeling projects, site and site improvement or expansion to new sites, existing sites, auxilary facilities, athletic facilities, or ancillary facilities at various schools.

MAINTENANCE, RENOVATION, AND REPAIR

Reimbursement of the maintenance, renovation, and repairs paid through the General Fund as permitted by Florida Statute

Maintenance, Renovation and Repair at Various School and District Sites

Demolition and Debris Removal (District Owned Property)

Deficiency, Remediation and/or Unforeseen Emergencies

MOTOR VEHICLE PURCHASES

Purchase of up to thirty-five (35) School Buses

Purchase of Maintenance Vehicles and Other Operations Support Vehicles

NEW AND REPLACEMENT EQUIPMENT, COMPUTER AND DEVICE HARDWARE AND OPERATING SYSTEM SOFTWARE NECESSARY FOR GAINING ACCESS TO OR ENHANCING THE USE OF ELECTRONIC AND DIGITAL INSTRUCTIONAL CONTENT AND RESOURCES, AND ENTERPRISE RESOURCE SOFTWARE

Purchase Furniture, Fixtures and Equipment (School and District Sites)

Purchase or lease technology equipment and software (School and District Sites)

Purchase enterprise resource software acquired via license/maintenance fees or lease agreement

Purchase software application for district-wide administration

PAYMENTS FOR EDUCATIONAL FACILITIES AND SITES DUE UNDER A LEASE-PURCHASE AGREEMENT

Annual master lease payments for various facilities and renovations

Debt service on certificates of participation for various sites

PAYMENT OF COSTS OF COMPLIANCE WITH ENVIRONMENTAL STATUTES, RULES, AND REGULATIONS

Removal of Hazardous Waste/Remediation - Various School and District Sites

Deficiency Remediation and/or Unforeseen Emergencies

PAYMENT OF PREMIUMS FOR PROPERTY AND CASUALTY INSURANCE NECESSARY TO INSURE THE EDUCATIONAL AND ANCILLARY PLANTS OF THE SCHOOL DISTRICT PAYMENTS OF COSTS OF LEASING RELOCATABLE EDUCATIONAL FACILITIES

Various School and District Sites

PAYMENTS OF SALARIES AND BENEFITS

Salaries and Benefits for Maintenance Employees

Salaries and Benefits for Planning and Growth Employees

Salaries and Benefits for Facility and Construction Employees

Salaries and Benefits for Code Compliance Employees

Salaries and Benefits for School Bus Drivers

CHARTER SCHOOL CAPITAL OUTLAY PROJECTS PURSUANT TO S. 1013.62(4), F.S.

PURCHASE OF REAL PROPERTY

CONSTRUCTION OF SCHOOL FACILITIES

PURCHASE OR LEASE OF PERMANENT OR RELOCATABLE SCHOOL FACILITIES

PURCHASE OF UP TO 5 VEHICLES TO TRANSPORT STUDENTS

RENOVATION, REPAIR, AND MAINTENANCE OF SCHOOL FACILITIES

PAYMENT OF THE COST OF PREMIUMS FOR PROPERTY AND CASUALTY INSURANCE NECESSARY TO INSURE SCHOOL FACILITIES

PURCHASE OR LEASE OF DRIVER'S EDUCATION VEHICLES, MAINTENANCE VEHICLES, SECURITY VEHICLES, OR VEHICLES USED IN STORING OR DISTRIBUTING MATERIALS AND EQUIPMENT

COMPUTER AND DEVICE HARDWARE AND OPERATING SYSTEM SOFTWARE NECESSARY FOR GAINING ACCESS TO OR ENHANCING THE USE OF ELECTRONIC AND DIGITAL INSTRUCTIONAL CONTENT AND RESOURCES, AND ENTERPRISE RESOURCE SOFTWARE

PAYMENT OF COSTS OF OPENING DAY COLLECTION FOR LIBRARY MEDIA CENTER

All concerned citizens are invited to a public hearing to be held on July 28, 2025, at 5:05 PM in the Commission Chambers, Lake County Administrative Building, 315 W. Main Street, Tavares, FL.

A DECISION on the proposed CAPITAL OUTLAY TAXES will be made at this hearing.